As an investor, you understand the importance of maximising returns while minimising risks. When it comes to property investment, negative gearing is a strategy you may have heard about but are unsure if it’s right for your portfolio. By understanding the fundamentals of negative gearing, you can determine if it aligns with your investment goals and risk tolerance. In this article, we will explore what negative gearing is, how it works from a tax perspective, the potential upside and risks, and whether it could be a viable option for your real estate investments. With the right information, you can make informed decisions about utilising negative gearing and its role in an investment property strategy. We will outline key considerations to weigh when deciding if negative gearing is worth pursuing or best avoided.

Negative gearing refers to a tax-efficient investment strategy where the costs of financing an investment exceed the income generated by that investment. The term typically applies to property investments where the interest cost of the loan used to purchase the property exceeds the rental income.

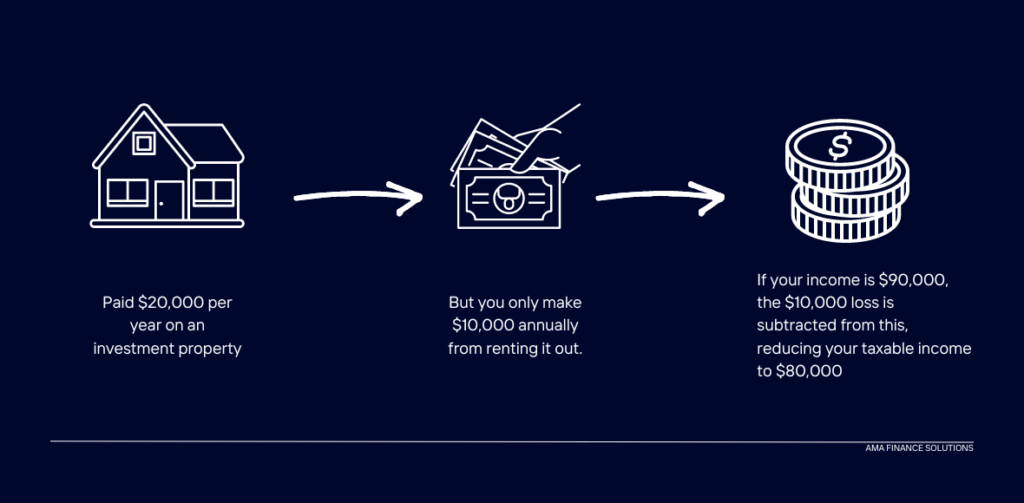

When you take out a loan to purchase an investment property, the interest charged on that loan is tax deductible. If the interest costs are higher than the rental income for that property, you can use that loss to offset other taxable income and reduce your tax bill. For example, if the interest costs for an investment property are $20,000 per year but the rental income is only $10,000, you can deduct the $10,000 loss from your salary or other income, reducing your total taxable income.

The main benefits of negative gearing are tax savings and the potential for capital growth. By offsetting rental losses against other income, you pay less in taxes each year. You are also able to purchase an investment property that may generate strong capital growth over the long run, even if it is not positively geared in the short term. Many investors aim to hold negatively geared properties for the long term, eventually turning them into positively geared investments. Other pros of negative gearing are:

While negatively geared properties may generate losses in the short term, the long term capital growth potential can produce solid profits. As property values increase over time, the equity in your investment also rises. When you eventually sell, this capital gain is taxed at a lower rate than standard income. For patient investors, the tax benefits of negative gearing now can be worth the capital gains later.

Over time, rent prices may increase at a higher rate than your mortgage repayments and other costs. This can turn a negatively geared property into a positively geared one, where it generates more income than expenses. At this point, your investment begins providing cash flow in addition to tax benefits and capital growth. With strategic property selection and active management, many investors are able to achieve this transition within 5 to 10 years.

Negative gearing allows property investors to deduct the losses from their investment properties from their taxable income. While this tax strategy may seem appealing, there are some significant downsides to consider:

By using leverage to finance the purchase, you have less control over the investment property. If rental demand drops or property values decline, you could end up owing more than the property is worth, while still being responsible for loan repayments and other costs. This could put you in a difficult financial position.

The strategy relies heavily on the tax deductibility of property costs and losses. If tax laws were to change, such as limiting or removing deductions for investment property expenses, the benefits of negative gearing would be significantly reduced. Your losses may end up costing you more in the long run.

Negative gearing relies on the assumption that property values and rents will increase over time to produce capital gains and eventual positive cash flow. However, property markets are cyclical and values do not always increase. During downturns or in oversupplied markets, property prices can stagnate or drop for extended periods. If you need to sell during these times, you may end up with a loss after accounting for transaction costs.

While negative gearing does offer tax advantages and the potential for strong long- term returns, the risks and potential downsides are substantial. As with any investment strategy, it is important to go in with realistic expectations and understand all the pros and cons before getting started. For some investors, the risks of negative gearing may outweigh the rewards.

Negative gearing primarily benefits higher-income earners in Australia who are able to leverage the tax benefits. Investors Property investors are able to offset losses from rental income against their taxable personal income. This reduces their tax liability and allows them to hold onto more of their rental income. Negative gearing also provides significant capital gains tax benefits when the property is sold, as only half of the capital gain is taxed.

The tax benefits of negative gearing disproportionately favor those in higher tax brackets. By offsetting losses against their personal income, high-income earners can achieve substantial tax savings. For example, an individual with a taxable income of $180,000 could save up to $63,000 in tax per year by negatively gearing a $500,000 investment property. Comparatively, someone earning $80,000 would only save up to $28,000.

Property investors are able to leverage negative gearing to build their portfolio and wealth over the long run. Although the rental income may not cover expenses in the short term, the capital gains and tax benefits provide incentives for investors to hold properties for the long term. Over several years, property values and rents often rise significantly, allowing investors to benefit from capital gains and a positively geared investment.

Banks and lenders also benefit from negative gearing, as it encourages property investors to borrow money to fund their investments. This results in more business and profits for the banks through interest charges on mortgages and investment loans. The tax incentives provided by negative gearing also make property investment an attractive option for borrowing money.

The Australian government is considering reforms to the current negative gearing tax incentives. Tax Revenue The government loses significant tax revenue each year due to negative gearing tax breaks. Limiting these concessions could increase the tax base and provide funding for government programs and services. However, reducing negative gearing benefits may decrease property investment and values, reducing associated stamp duty and capital gains tax revenue.

Restricting negative gearing is often proposed as a way to improve housing affordability, as it may reduce demand for investment properties. However, it could also decrease the supply of rental housing if fewer investors buy properties. This could drive up rents, negatively impacting renters.

If changes are made, the government may opt to grandfather existing arrangements, only applying new rules to future property investments. This compromises the effectiveness of any reforms but avoids retrospectively changing the rules for current investors.

Implementing changes over time with a long transition period allows current investors and the property market to adjust. A gradual phase-in of new rules may minimise disruption while still achieving the goal of limiting concessions to improve affordability or increase the tax take. However, a protracted transition also delays the benefits of reform.

Negative gearing reform remains controversial, with valid arguments on both sides. The government must weigh the pros and cons of adjusting negative gearing and consider options to make the system fair and sustainable, without unduly impacting the market or disadvantaging some groups. Comprehensive modelling and analysis are required to determine the best path forward.

In conclusion, while negative gearing can provide tax benefits for property investors, it also contributes to housing unaffordability for many potential buyers. Consider both sides of the issue to determine if negative gearing aligns with your financial and ethical goals. Examine if property investment is right for you, and if so, use negative gearing strategically. Overall, approach negative gearing thoughtfully, looking beyond surface-level pros and cons. You now have a more nuanced understanding to make informed decisions about property investment and negative gearing’s role. Use this knowledge to pursue smart financial choices rooted in your values.